In November 2014, the FCA published Proposed guidance on financial crime systems and controls that lays out sound advice on how to manage compliance and mitigate the risk of financial crime activity across a financial institution.

In particular, they specifically advise

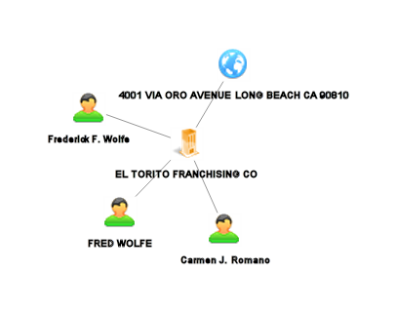

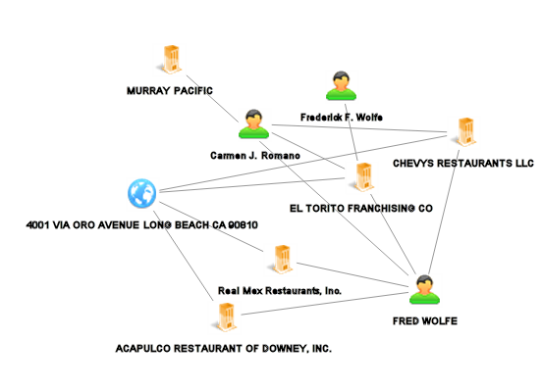

“carrying out searches on a corporate customer’s directors or other individuals exercising control to understand whether their business or integrity affects the level of risk associated with the business relationship.”

Good information is required in order to do this correctly. We look not only at the current employment of the directors, but also their present and past business activities and relationships is necessary in order to assess the risk associated with the individual.

Much like an HR screening, or a more detailed background check for a government security clearance, looking at the individuals more closely reveals patterns and relationships of risk, such as indications of past criminal activity, civil disorder or close relationships with politically exposed individuals or suspected criminals.

Most people still use general internet searches for this purpose. However, tools such as KYC3 are the first step towards a true professional approach. These offer current and historical company data and comprehensive news coverage and functionality such as qualified relationship graphs of the individuals. We can quickly understand the subject’s activity with such information. In an interesting development in the US Courts, the use of such tools is commonly becoming part of legal settlements in cases of non-compliance.

Of course, if one wants to really achieve the same level of certainty that a “Top Secret SCI” clearance would entail, then we would need an active investigation, complete with agents discretely collecting information on the individuals in order to form an accurate and very well informed opinion. There are several companies out there that offer such services already. Is this coming soon to a financial institution near you?